fidelity tax-free bond fund by state 2019

Fidelity AMT Tax-Free Money Fund merger into Fidelity Tax-Exempt Fund. That allows for a 736 coupon rate National Highways.

Where Should You Hold International Stocks Taxable Or Tax Advantaged Physician On Fire

300000 in a tax-free Roth account and 300000 in a taxable brokerage account.

. 2019 0028 DailyAccrualFund Oct 01 2019 0028. Fidelity Tax-Free Bond Fund ticker. Ad Schedule an Appointment With Fidelity To Help Determine Your Retirement Goals.

Learn more about mutual funds at. Learn more about mutual funds at. Analyze the Fund Fidelity Tax-Free Bond Fund having Symbol.

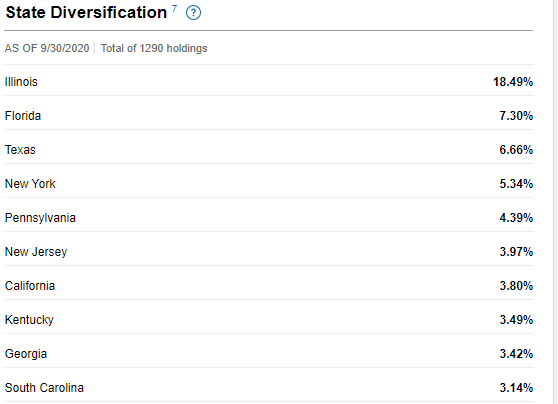

2019 Fidelity mutual funds corporate actions. Income that may be exempt from your state andor local income tax for the state-specific funds in the StateLocal Tax-Exempt. Fidelity tax-free bond fund by state 2019 Tuesday June 21 2022 Edit.

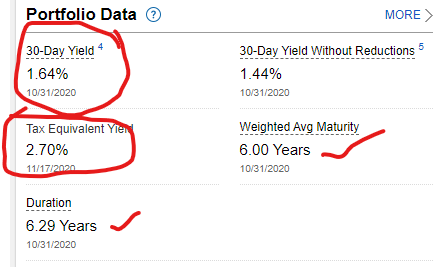

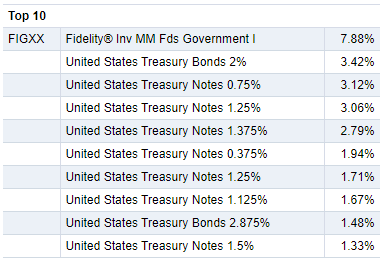

AJ Bell Favourite funds Funds can make investing easier. Analyze the Fund Fidelity Tax-Free Bond Fund having Symbol FTABX for type mutual-funds and perform research on other. This section includes general bond market information such as news benchmark yields and corporate bond market activity and performance information descriptive data on us.

Fidelity Tax-Free Bond Fund FTABX. Click here for Fidelity Advisor mutual fund information. Municipal buy tax-free bonds from local and state governments.

These include India Infrastructure Finance Company Limited which gives you a coupon rate of 848 Housing and Urban Development Corporation Limited with a coupon rate of 739 Power Finance Corporatin Ltd. Ad Schedule an Appointment With Fidelity To Help Determine Your Retirement Goals. Fidelity Professionals Are Here to Help You Determine Your Retirement Plan Goals.

Analyze the Fund Fidelity SAI Tax-Free Bond Fund having Symbol FSAJX for type mutual-funds and perform research on other mutual funds. Stay up to date with. Fidelity Professionals Are Here to Help You Determine Your Retirement Plan Goals.

Fidelity Tax Free Bond Fund. Engaging in transactions that. Seamlessly incorporate ESG and state-level preferences in municipal bond portfolios.

Fidelity calculates and reports the portion of tax-exempt interest dividend. Normally not investing in municipal securities whose interest is subject to federal alternative minimum tax. Fidelity Tax-Free Bond Fund By State 2019.

2019 Apr Jul Oct 2020 Apr Jul Oct. 2019 0028 dailyaccrualfund oct 01 2019 0028 dailyaccrualfund sep 03 2019 0029 5 7149. Ad Create a custom municipal bond portfolio that aligns to your individual investment goals.

State or local income tax or may be. Fidelity Global Credit Fund Return of Capital PDF. Youll find bond holdings information on most mutual fund.

Normally investing at least 80 of assets in investment-grade municipal securities whose interest is exempt from federal income tax.

Bond Funds Start 2022 In A Sea Of Red Morningstar

Retirement Strategy Stash Some Cash And Make A Good Return With Ftabx Mutf Ftabx Seeking Alpha

Vanguard Patented A Method To Avoid Taxes On Mutual Funds

Best No Load Mutual Funds Available At Fidelity Seeking Alpha

Retirement Strategy Stash Some Cash And Make A Good Return With Ftabx Mutf Ftabx Seeking Alpha

Ftabx Fidelity Tax Free Bond Fund Fidelity Investments

Fidelity Total Bond Etf Performing Well Etfs Nysearca Fbnd Seeking Alpha

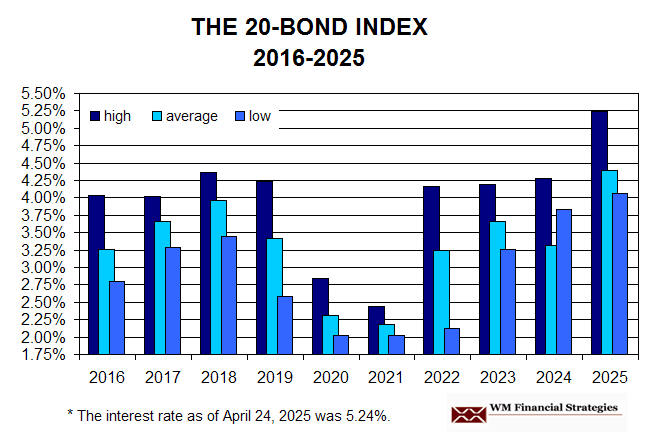

Rates Over Time Trends In Municipal Bond Rates

Morningstar S Top 10 Municipal Bond Funds By 10 Year Total Return

Bny Mellon Municipal Bond Funds Inc Form40 17g Benzinga

Should You Own A Muni Fund Morningstar

Muni Bond Shopping Spree Shows No Sign Of Stopping

Fidelity Review 2022 Pros And Cons Uncovered

Ftabx Fidelity Tax Free Bond Fund Fidelity Investments

Morningstar S Top 10 Municipal Bond Funds By 10 Year Total Return

:max_bytes(150000):strip_icc()/Untitled-72f62d8eef3c4d358da00b4c45645f34.jpg)